Thanks to the ongoing Digital India push, dealing with customs has become way simpler than before. One tool that’s truly transforming the trade landscape is ICEGATE. In this ICEGATE overview, we’ll explore how this digital customs portal is revolutionizing the way importers and exporters handle customs paperwork.

What is ICEGATE? An ICEGATE Overview

ICEGATE stands for Indian Customs Electronic Commerce/Electronic Data Interchange Gateway. It’s an online platform managed by Indian Customs that enables traders to file all their customs documents digitally. Whether you’re a small business or a large corporation, ICEGATE helps you get goods moving faster across borders by eliminating mountains of paperwork and long waiting times.

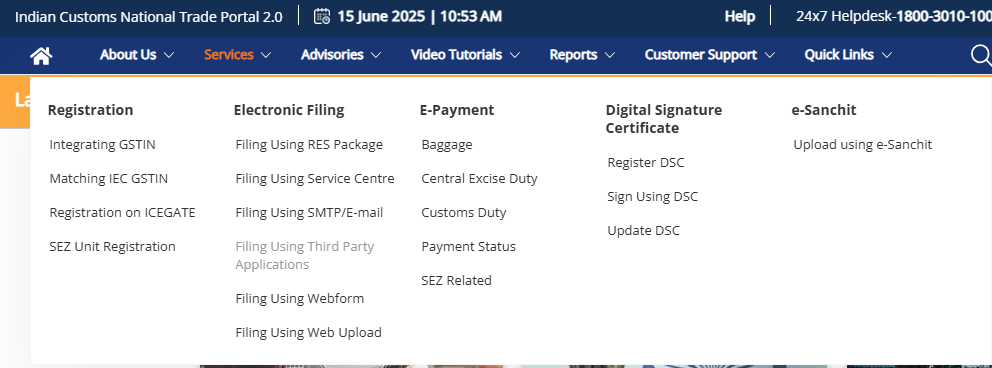

At its core, ICEGATE is a one-stop digital hub where you can:

- Submit customs forms like Bills of Entry and Shipping Bills electronically

- Connect with government bodies, ports, banks, and other key trade stakeholders

- Speed up customs clearance through real-time updates and automated processing

Who Should Use ICEGATE? Key Users in ICEGATE Overview

If you’re involved in international trade, ICEGATE is a must-use platform:

- Importers and exporters: File customs paperwork online, track shipment status in real-time, claim IGST refunds, and ensure regulatory compliance—all without leaving your desk.

- Customs brokers: Manage document filings for multiple clients digitally, reducing paperwork and improving communication with customs officials.

- Shipping and logistics companies: Submit cargo details online, coordinate with ports and customs, and avoid costly delays.

- Banks and financial institutions: Facilitate secure, fast customs duty payments and process refunds efficiently through ICEGATE.

ICEGATE Portal Services and Their Benefits

The ICEGATE overview would be incomplete without highlighting its key services:

- Electronic filing of Bills of Entry and Shipping Bills—no more physical submissions

- Secure online payment of customs duties integrated with authorized banks

- Real-time tracking of documents and shipment clearance status

- Digital communication with customs for faster processing

- Efficient handling of IGST refund and duty drawback claims

- Seamless integration with DGFT, ports, banks, and logistics providers

Why Use ICEGATE? Perks from Our ICEGATE Overview

Here’s why ICEGATE is a game-changer for India’s trade ecosystem:

- Paperless process: File customs documents electronically and save time.

- Speed: Faster customs clearance means quicker delivery to customers.

- Real-time tracking: Stay updated on your shipment and document status.

- Secure payments: Pay customs duties safely through trusted banks.

- Quick refunds: IGST and duty drawback claims are processed faster.

- 24/7 access: Work from anywhere, anytime.

- Smooth coordination: Connects all players in the trade chain digitally.

- Cost-effective: Reduce paperwork and operational expenses.

- Compliance support: Stay aligned with customs laws and regulations.

Documents Required for ICEGATE Registration

To get started with ICEGATE, keep these documents ready:

- Import Export Code (IEC) issued by DGFT

- Digital Signature Certificate (DSC) for secure filings

- Valid government ID (Aadhaar, Voter ID, Passport, or Driving License)

- PAN card for tax verification

- Authorization letter if registering on someone’s behalf

- GST Registration Certificate (if applicable)

- Bank account details including IFSC code

- Business registration proof (Incorporation Certificate, Partnership Deed, etc.)

Wrapping Up This ICEGATE Overview

The ICEGATE platform is transforming customs clearance in India by digitizing and simplifying the entire process. Whether you are an importer, exporter, customs broker, or logistics provider, ICEGATE offers faster, more transparent, and efficient trade operations.

If you haven’t explored ICEGATE yet, this is the perfect time to embrace hassle-free customs clearance and enjoy the benefits of India’s digital customs revolution.

Upcoming Projects

- How to Register on ICEGATE Portal : Link to your detailed guide on ICEGATE registration:

“To get started quickly, check out our step-by-step guide on how to register on ICEGATE portal.” - Customs Clearance Process in India : Explain the full customs clearance journey for importers/exporters:

“Understanding the customs clearance process in India can help you navigate trade smoothly.” - Benefits of Digital India for Traders : Show how Digital India initiatives (including ICEGATE) are empowering businesses:

“Learn more about the benefits of Digital India for traders.” - IGST Refund and Duty Drawback Claims Explained : Detailed info on how to claim refunds through ICEGATE:

“Our article on IGST refund and duty drawback claims covers how ICEGATE speeds up this process.” - Role of Customs Brokers in Digital Trade : Explain customs brokers’ importance and how they use ICEGATE:

“Explore the role of customs brokers in digitized trade.”

All in all, ICEGATE is designed to bring everyone involved in trade onto the same digital page.

Disclaimer

The information shared in this blog is intended solely for informational purposes. While we’ve made every effort to ensure accuracy based on research and publicly available sources at the time of writing, this content should not be considered exhaustive or official guidance.

My Avinya does not take responsibility for any inaccuracies, omissions, or changes that may occur after publication. Readers are advised to independently verify any technical, legal, or procedural details related to ICEGATE, customs regulations, or government processes before making decisions. For the most current and authoritative information, please refer to official sources such as ICEGATE.gov.in or consult with a qualified expert.

1 thought on “ICEGATE Overview: How Digital India is making Customs a Breeze”