The Government e-Marketplace (GeM) is India’s digital procurement platform where ministries, PSUs, and departments purchase goods and services. For MSMEs (Micro, Small, and Medium Enterprises), GeM offers an opportunity to directly connect with government buyers and grow their business.

To encourage participation, GeM has integrated MSME (Udyam) benefits into its system. From EMD exemptions to faster payments, MSMEs enjoy significant relief while selling to the government.

What is MSME (Udyam) Registration?

MSME (or Udyam) Registration is a government-issued certificate for Micro, Small, and Medium Enterprises. It validates your business as an MSME and provides access to financial and procurement benefits.

Why MSMEs Need Udyam Certificate

- Required for availing GeM MSME benefits.

- Unlocks priority in government procurement.

- Provides access to subsidies, loans, and credit guarantees.

- Ensures faster approval of tenders and contracts.

Step-by-Step Udyam Registration Process

- Visit Udyam Registration Portal.

- Enter Aadhaar number of business owner.

- Provide PAN & GST details.

- Fill in business info (type, activity, number of employees, turnover).

- Submit form → Udyam certificate with QR code is generated instantly.

Note: Udyam registration is free of cost and permanent.

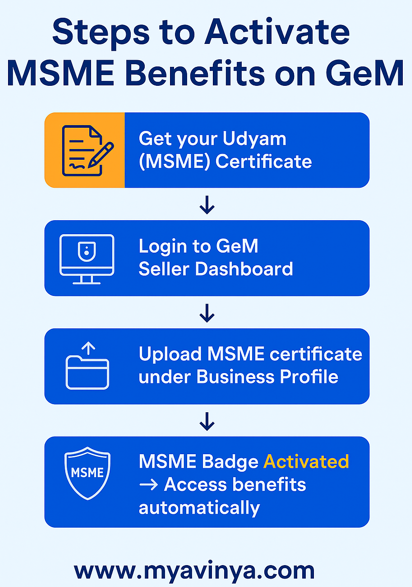

Linking MSME Certificate with GeM Seller Profile

Once you have an Udyam certificate, you can link it to your GeM seller account:

- Login to GeM Dashboard.

- Go to Business Profile → MSME Certificate Upload.

- Enter Udyam details and upload certificate.

- Once verified, your profile displays the MSME badge.

This badge allows you to access all GeM MSME benefits automatically.

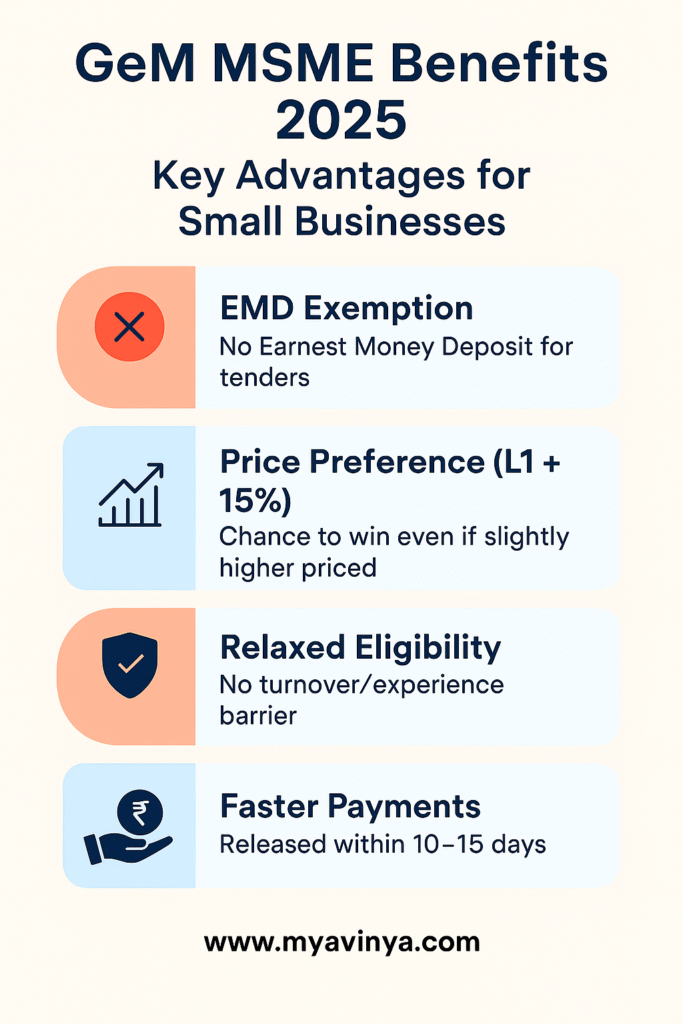

Key GeM MSME Benefits in 2025

The government has introduced several incentives for MSMEs on GeM:

1. EMD Exemption

- MSMEs are exempted from paying Earnest Money Deposit (EMD) while participating in tenders.

- This significantly reduces the financial burden and encourages participation.

2. Price Preference (L1 + 15% Rule)

- If an MSME’s bid is within 15% of the lowest bid (L1), they are allowed to match L1 price and still win the order.

- Ensures MSMEs don’t lose contracts only due to pricing gaps.

3. Relaxed Eligibility Norms

- MSMEs are exempted from conditions like minimum turnover and prior experience.

- This enables new and small enterprises to compete fairly with established players.

4. Faster Payments

- GeM mandates that MSME payments are cleared within 10–15 days.

- Delayed payments attract interest penalties, protecting MSMEs from cash-flow issues.

Fact: Over 37% of GeM order value comes from Micro & Small Enterprises (MSEs), highlighting their importance in government procurement.

Financing Support for MSMEs on GeM

Apart from procurement reliefs, MSMEs also get access to financing support:

1. GeM Sahay Loan Scheme

- Collateral-free working capital loans for GeM sellers against purchase orders.

- Loan approval in 10 minutes; disbursal within hours.

- Loan range: ₹40,000 – ₹10 lakh.

👉 Also read: GeM Sahay 2.0 – Fast Collateral-Free Loans for Sellers

2. CGTMSE Collateral-Free Loans

- MSMEs can avail loans up to ₹5 crore under the Credit Guarantee Fund Trust for MSEs (CGTMSE).

- Government provides credit guarantee coverage to banks/NBFCs, encouraging lending to MSMEs.

Statistics – MSMEs on GeM

- Over 23 lakh MSMEs are registered on GeM.

- MSMEs contribute to 37.87% of total GeM order value.

- In FY 2023–24, MSMEs fulfilled orders worth ₹22,000+ crore via GeM.

This proves MSMEs are the backbone of GeM, and the platform continues to expand opportunities for them.

FAQs on GeM MSME Benefits

Q1. What are the key GeM MSME benefits?

EMD exemption, price preference, relaxed eligibility, and faster payments.

Q2. How can I claim MSME benefits on GeM?

Upload your Udyam certificate in GeM seller profile → MSME badge gets activated.

Q3. Can a startup also claim MSME benefits?

Yes, if registered as an MSME under Udyam. Startups can also explore GeM Startup Runway

Q4. What is the L1 + 15% rule?

If an MSME’s bid is within 15% of the lowest bid (L1), they can match L1 and win the contract.

Q5. How soon are MSME payments released on GeM?

Within 10–15 days, else buyers pay interest for delays.

Useful Resources

Conclusion

The GeM MSME benefits ensure that small businesses can compete on equal footing with large enterprises. With EMD exemption, price preference, faster payments, and relaxed eligibility, MSMEs get a clear advantage in government procurement.

When combined with Udyam registration and financing schemes like GeM Sahay, MSMEs can grow faster, win contracts confidently, and strengthen India’s digital procurement ecosystem.

Disclaimer

This blog is for informational purposes only. We are not affiliated with GeM, the Government of India, or any of its departments. Please verify the latest updates and policies directly on the official GeM Portal before making decisions.

2 thoughts on “GeM MSME Benefits 2025: Udyam Registration, Exemptions & Buyer Preference”