The Government e-Marketplace (GeM) is India’s central procurement platform. To ensure seller accountability and buyer protection, GeM requires sellers to maintain a refundable security deposit known as GeM Caution Money.

This deposit acts as a safeguard against defaults, contract failures, or bid withdrawals. In this blog, we’ll cover:

- What is GeM Caution Money?

- Deposit slabs based on turnover

- Exemption categories (MSEs, SHGs, artisans, women entrepreneurs)

- Deduction rules and conditions

- Step-by-step process to deposit caution money

- Refund process

Also read: GeM Procurement Options 2025 to understand how buyers purchase through GeM.

What is GeM Caution Money?

GeM Caution Money is a one-time refundable deposit that sellers must maintain in an escrow-linked GeM account.

It is not a fee but a security measure to:

- Build trust in government procurement.

- Discourage non-serious sellers.

- Ensure contracts are honored.

⚠️ Note: GeM may deduct caution money (partially or fully) in case of defaults or bid withdrawals.

GeM Caution Money Deposit Slabs

The deposit amount depends on the seller’s last financial year turnover:

- Turnover < ₹1 Cr → ₹2,000

- Turnover ₹1–10 Cr → ₹10,000

- Turnover > ₹10 Cr → ₹25,000

- No turnover → ₹2,000 minimum

The slab is based only on previous year turnover and doesn’t change mid-year.

GeM Caution Money Exemption Categories

Certain sellers are exempted from paying caution money:

- Self-Help Groups (SHGs)

- Artisans & Weavers

- Women entrepreneurs (MSE Women)

- SC/ST MSEs

- Farmer Producer Organizations (FPOs)

- ODOP sellers (One District One Product – on nodal request)

For these sellers, the deposit threshold is ₹0, meaning they can sell without paying caution money.

GeM Caution Money Deduction & Forfeiture Rules

The GeM SPV may deduct caution money in full/part in these cases:

- Failure to execute a GeM contract.

- Withdrawal of a bid during validity.

- Failure to furnish performance security in bids/RA.

- Ignoring contract obligations without performance security.

If balance falls below the required slab, the seller’s account is put on hold and participation in bids/uploads is restricted until replenished.

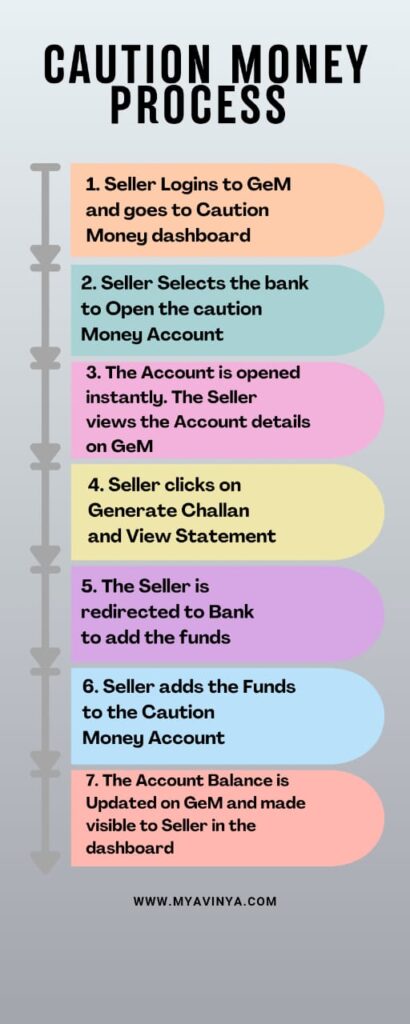

Step-by-Step Process to Deposit GeM Caution Money

Follow these steps to deposit caution money on the GeM portal:

- Login → Go to Caution Money Dashboard.

- Select bank → Open a Caution Money Account.

- Account opens instantly → details visible on GeM.

- Click Generate Challan and View Statement.

- Redirected to bank → Add funds.

- Deposit funds into caution money account.

- Balance updates on GeM dashboard automatically.

GeM Caution Money Refund Process

Refunds are only allowed when:

- You close your GeM account, or

- You deposited excess funds.

Refunds are credited to your primary verified bank account after verification.

Key Features of Caution Money Account

- No KYC required (opens instantly).

- Linked to GeM escrow account only.

- One account per seller.

- Balance visible anytime in dashboard.

FAQs on GeM Caution Money

Q1. What is GeM Caution Money?

A refundable deposit sellers must maintain to ensure compliance on GeM.

Q2. How much deposit is required?

₹2,000 (turnover < ₹1 Cr), ₹10,000 (₹1–10 Cr), ₹25,000 (>₹10 Cr).

Q3. Who is exempted from caution money?

SHGs, artisans, weavers, women MSEs, SC/ST MSEs, FPOs, ODOP sellers.

Q4. When is it deducted?

For defaults, bid withdrawals, or failure to furnish performance security.

Q5. When can I get a refund?

Only on account closure or refund of excess deposit.

Disclaimer

This blog is for informational purposes only. Please verify details on the official GeM Portal. We are not affiliated with GeM or the Government of India.

1 thought on “GeM Caution Money 2025: Deposit Rules, Exemptions & Refund Process”