When I first started learning about international trade, the term Letter of Credit (LC) kept coming up everywhere — in export-import textbooks, government trade guides, and finance forums. At first, it felt like a complicated banking jargon.

But once I worked with exporters in India, I realized how practical and life-saving an LC can be. Imagine shipping goods worth crores overseas, and then waiting endlessly for payment — that’s the nightmare exporters face. LC acts like a safety net, ensuring that the bank steps in and guarantees your payment.

In this blog, I’ll explain Letter of Credit (LC) 2025 in India in simple words, along with real-life examples I’ve seen exporters face, so you can understand it the way people in business actually use it.

Table of Contents

What is a Letter of Credit (LC) 2025?

In simple words, an LC is a promise by the buyer’s bank that you will get paid as an exporter, as long as you submit the required documents (like invoice, bill of lading, etc.) correctly.

I first read this definition in an ICC guide, but it clicked for me only when I saw an exporter friend in Surat ship a container of garments to Europe. Instead of worrying about whether the buyer would pay on time, he relaxed knowing that HSBC (the buyer’s bank) had issued an irrevocable LC. Once he submitted the shipping papers, the money was credited.

That’s when I understood: an LC is not just theory — it’s a bank-backed safety net.

Why is LC Important in 2025?

Back in college, I read in a trade finance book that LC is called “the lifeline of exporters.” Later, I saw why:

- An engineering parts exporter from Pune told me he once faced a 90-day payment delay on open account trade. After that, he switched to usance LCs, and his cash flow became predictable.

- A handicraft exporter from Jaipur said buyers sometimes raise false quality complaints to delay payments. But with an LC, the bank releases payment based on documents, not buyer excuses.

So whether you are exporting textiles, machinery, or spices — an LC gives you assurance that your hard work pays off.

Real-Life Example: Textile Exporter from Tirupur

One of my most eye-opening experiences was with a Tirupur-based textile exporter. He received a large order from a European buyer worth ₹2.5 crore. Initially, the buyer asked for a 60-day open credit, but the exporter insisted on an irrevocable LC confirmed by Citibank.

Why? Because his bank gave him packing credit (a pre-shipment loan) against the LC. That loan allowed him to buy raw cotton, pay workers, and manage production. After he shipped the goods and submitted documents, Citibank paid him without delay.

He later told me: “Without LC, I would have been stuck between production costs and delayed payments. LC saved my business that season.”

LC Process in India – Explained Simply

Here’s how the process works in real life:

- Agreement: Buyer and seller agree to use LC.

- Issuing Bank: Buyer’s bank issues LC (say Deutsche Bank).

- Advising Bank: Exporter’s bank in India (say SBI) confirms authenticity via SWIFT MT700.

- Shipment: Exporter ships goods → submits documents (invoice, bill of lading, packing list).

- Verification: Bank checks documents → even a small mismatch can delay payment (I once saw an exporter’s payment delayed because the packing list weight didn’t match invoice weight).

- Payment: If documents are correct, exporter gets paid.

This process sounds rigid, but it’s what keeps exporters safe.

LC Charges in India 2025 (With Example)

My friend who exports engineering goods from Rajkot shared his recent LC charges from an Indian bank:

- Opening Fee: 0.40% of LC value (paid by importer)

- Advising Charges: ₹3,500 (paid by him)

- Confirmation Charges: 0.25% (he chose Citibank confirmation)

- Document Handling Fee: ₹4,000

| Type of Charge | Range in India (2025) | Who Pays? | Example from Rajkot Exporter |

|---|---|---|---|

| Opening Fee | 0.25% – 1% | Importer | 0.40% by buyer’s bank |

| Advising Charges | ₹1,000 – ₹5,000 | Exporter | ₹3,500 |

| Confirmation Charges | 0.15% – 0.50% | Exporter | 0.25% |

| Document Handling Fee | ₹2,000 – ₹7,500 | Exporter | ₹4,000 |

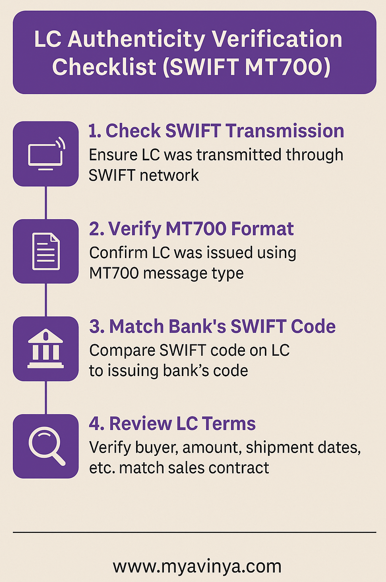

How Exporters Verify LC Authenticity (2025)

When I first heard of fake LCs, I thought it was rare. But one Mumbai exporter told me how he almost shipped goods on the basis of a photocopied LC that never came through SWIFT.

Here’s what Indian exporters do now:

- Check SWIFT MT700: Only trust LCs that arrive via SWIFT.

- Cross-check SWIFT Code: Verify issuing bank’s BIC code online.

- Match Terms with Contract: Amount, Incoterms, and shipment dates must match.

- Prime Bank Confirmation: If the issuing bank is small, get confirmation from HSBC, Citi, or Standard Chartered.

To understand the most common types of discrepancies and how to avoid them, read our detailed guide on LC Discrepancies & How to Avoid Them 2025

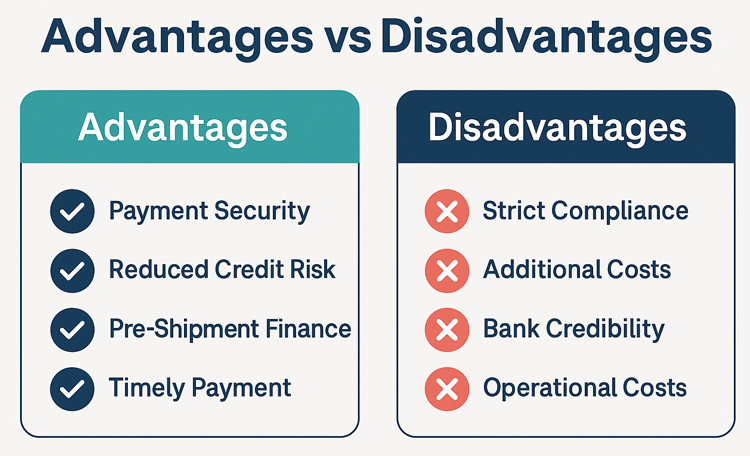

Advantages of LC (From Real Exporters)

- A Mumbai pharma exporter said: “It’s my shield against buyers who delay payments.”

- A Noida machinery exporter uses LC to get pre-shipment finance every time.

- A Kerala spice exporter loves LCs because disputes don’t matter — as long as documents are correct, payment comes.

Disadvantages of LC (Hard Truths)

- Costly: A Kolkata leather exporter told me LC fees cut into his profit margins.

- Strict Documentation: A friend in Ludhiana lost a payment because of a typo in the invoice date.

- Dependence on Bank’s Strength: If the issuing bank is weak, you’re at risk unless confirmed by a prime bank.

LC vs Bank Guarantee vs Advance Payment (With Indian Context)

| Feature | Letter of Credit | Bank Guarantee | Advance Payment |

|---|

| Risk for Exporter | Low | Medium | None |

| Risk for Importer | Medium | Low | High |

| Common in India | Textiles, Pharma, Machinery | Infra Projects | Small export orders |

| Real Example | Tirupur exporter uses LC | Contractor in Delhi uses BG | Small handicraft exporter asks for advance |

FAQ

Q1. Is a Letter of Credit (LC) 2025 safe for exporters in India?

Yes, especially when it is an irrevocable confirmed LC. Exporters get guaranteed payment as long as documents meet LC terms.

Q2. How much do LC charges cost in India?

Generally between 0.25% – 2% of the transaction value. Importers pay the opening fee, while exporters bear advising and confirmation charges.

Q3. How can exporters verify if an LC is genuine?

Always check if the LC comes via SWIFT MT700, verify the issuing bank’s SWIFT code, and request prime bank confirmation if needed.

Q4. Can an LC be cancelled?

An irrevocable LC cannot be cancelled unless all parties agree.

Q5. What documents are required under LC in India?

Typically: invoice, bill of lading, packing list, certificate of origin, and insurance documents. Some banks may also ask for e-BRC in India.

Conclusion

When I first read about LCs, they felt complicated. But after seeing how exporters across India actually use them, I understood why LC is still the backbone of global trade in 2025.

For Indian exporters, my advice is simple:

- Always prefer an Irrevocable Confirmed LC.

- Double-check authenticity via SWIFT MT700.

- Invest in good documentation staff — one small mistake can cost lakhs.

Disclaimer

This blog is for educational purposes, based on personal study, industry cases, and exporter experiences. Always consult your bank before finalizing any LC transaction.

2 thoughts on “Letter of Credit (LC) 2025 in India – Complete Guide for Exporters”